5 Reasons Why ‘Earn-and-Burn’ Loyalty Programs Fail (And the New Model Emerging)

Many consumers entrust banks or financial services institutions with everything from mortgages, investments, life insurance, personal and business banking, car loans, and more.

So many consumers are loyal to their banks, but is that loyalty reciprocated?

Many offer rewards programs that use the ‘Earn and Burn’ approach.

This is where customers ‘earn’ points or rewards by spending, such as credit card transactions, and then ‘burn’ or redeem these accumulated rewards for various benefits.

While this approach encourages repeat business, ‘Earn and Burn’ programs typically don’t create real customer loyalty.

Here’s 5 reasons why ‘Earn and Burn’ loyalty programs fail, followed by a new type of loyalty model that may take its place.

Reason #1: People Join But Are Not Active

Facts are facts.

97% of loyalty programs only rely on transaction-based incentives, but 77% of these fail within the first two years, reports Capgemini.

A big reason is that people join, but they are not active.

A recent Yotpo survey found that 90% of people would join a loyalty program offered by their favorite brands. However, while a consumer belongs to 14.8 loyalty programs on average, they actively engage in only 6.7.

Despite their appeal in getting customers to opt in, these programs often struggle to deliver meaningful engagement and profitability over the long term.

In other words, transaction-based loyalty programs do little for actual client loyalty.

97% of loyalty programs only rely on transaction-based incentives, but 77% of these transactional programs fail within the first two years.

Capgemini Consulting Analysis

Reason #2: Too Many Rewards Go Unused

‘Earn and Burn’ loyalty programs are transaction-centric.

They reward clients for specific transactions or purchases, reducing loyalty to a mere financial exchange.

This transactional approach does little to nurture a deeper emotional connection between clients and brands, including financial institutions.

Customers often use their credit cards to the fullest, spend money, and earn points, but it’s not uncommon to see that they hoard points without ever redeeming them.

Often, the rewards on offers—be it airline miles, free hotel stays, or merchandise—don’t align with individual preferences or lifestyle needs.

Globally, $360 billion worth of reward points go unredeemed each year. This low perceived value reduces engagement with the program, limiting its effectiveness as a retention tool.

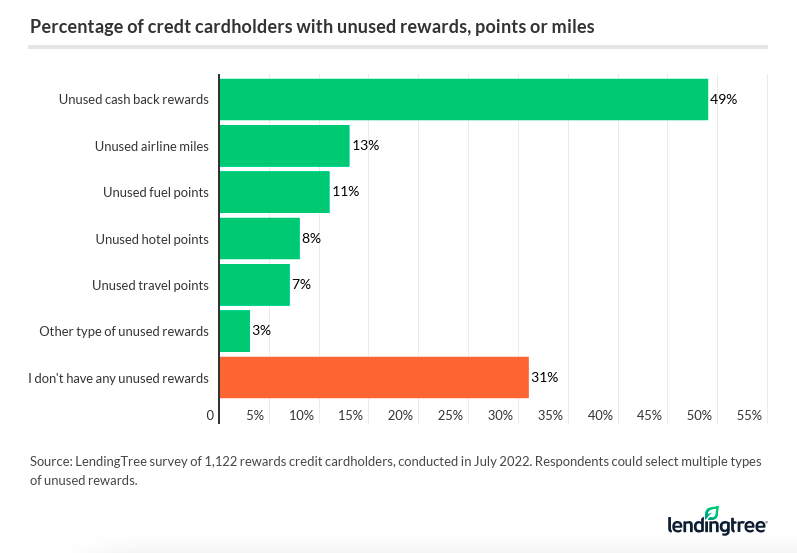

Some other credit card rewards stats to consider by LendingTree:

- Nearly 70% of rewards credit cardholders are sitting on unused cashback, points, or miles

- 40% of rewards credit cardholders haven’t cashed in on any rewards in the past year

- 15% of rewards cardholders say some of their rewards, points, or miles expired before they could use them

Reason #3: Using a One-Size-Fits-All Rewards Approach

A generic, one-size-fits-all loyalty program isn’t going to cut it anymore for consumers.

An Antavo study found that when asked to name a feature or strategy they would most like to invest in their loyalty programs, the top answer was ‘personalization.’

Why is that?

Because 80% of people are more likely to do business with a company that offers personalized experiences.

This is an important aspect to pay attention to, especially after the fact that 60% of HNW clients report unsatisfactory experiences with their firm’s personalized information or services.

Consumers don’t want to be treated as numbers but as people.

Lack of personalization is also a problem for industries with little brand differentiation, like fast food chains, where 80% of loyalty program members want to receive special treatment not available to other customers.

This especially goes for millennials.

According to Colloquy, 25% of millennials joined a program last year because it offered access to members-only events.

Acknowledging that personalization matters is key. Because if customers don’t feel a business cares about them, 68% will stop transacting with that business.

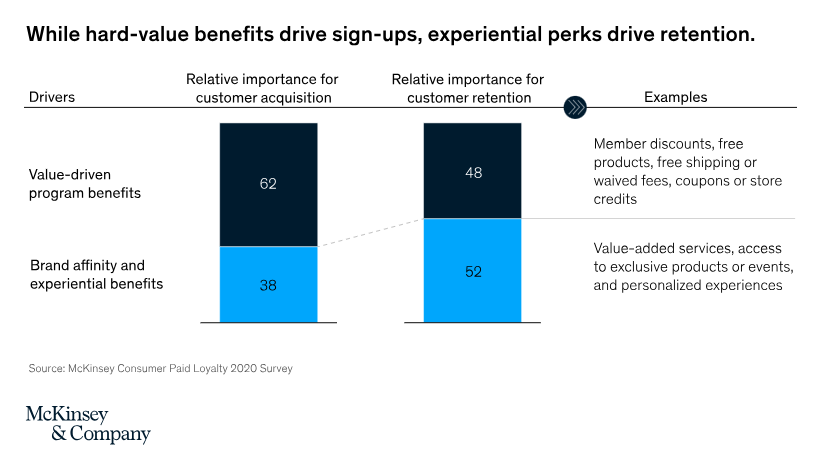

See how hard-value benefits like discounts and free products may hook consumers into the program, but they are not enough to retain them, according to McKinsey & Company.

Reason #4: Point Redemption Policies and Dates Are Not Clear

“In an effort to reduce loyalty liability, some brands may be tempted to take shortcuts. This can take the form of shortening the validity periods for rewards (i.e., making points expire more quickly or accelerating their devaluation period over time),” explains Len Covello.

From a customer’s point of view, this doesn’t make any sense. They earned the rewards, and now the company [is] taking them away? That is not the basis for a positive customer experience.

Dan Gingiss

This is hard to believe, but it’s true.

About 1/3 of all loyalty points are never cashed due to redemption hurdles, which can be a major frustration point for consumers.

According to an Epsilon report, these obstacles translate to redemption expiration dates, spending minimums, or redemption windows.

A significant setback for ‘Earn and Burn’ programs, really.

Reason #5: No Guarantee of Long-term Loyalty

‘Earn and Burn’ programs are 100% transactional. Once the reward is achieved, customers may easily switch brands if another offers a better incentive.

The issue here is that the loyalty is directed more toward the reward itself rather than the brand offering it.

According to Capgemini, emotions are the primary driver of loyalty, but emotionally engaged consumers expect two-way interaction.

Their study found that most emotionally engaged consumers (86%) expect a brand to show how it is loyal to them, regardless of participation in a “formal” loyalty program.

Moving Away From ‘Earn and Burn’ and Towards a Relationship-Based Loyalty Program

When the ‘Earn and Burn’ approach fails and wealth management firms start to lose clients, the best solution is switching from a transactional model to a relationship-based one.

Relationship-based loyalty programs focus on cultivating and nurturing long-term connections with their customers.

Instead of only offering tangible rewards, they engage customers on a personal level, creating memorable experiences that resonate emotionally.

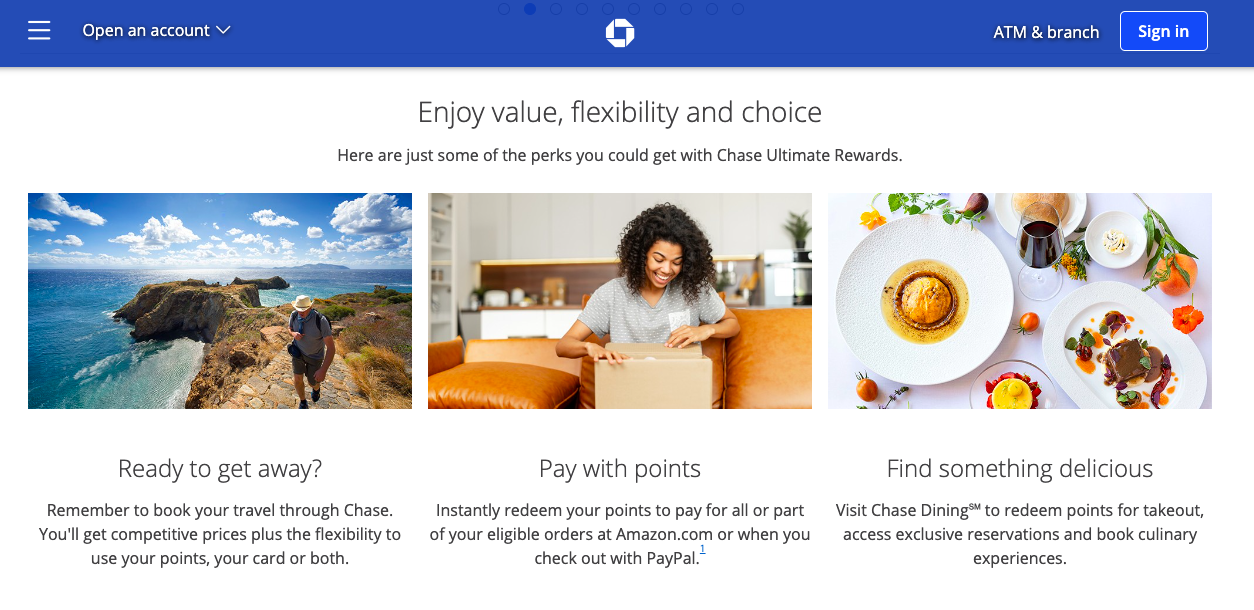

See, for example, Chase’s Ultimate Rewards program.

While they offer the possibility to use points to pay for products on Amazon or Apple Store, their customers can also redeem them for restaurant reservations, exclusive culinary experiences, and travel purchases.

Offering personalized and exclusive offers and experiences is what makes these loyalty programs successful.

The more personal, the better.

And not only that. If the customers can also give back to society or their community, their loyalty to the brand goes a long way.

Citibank’s Citi ThankYou® Rewards program allows customers to donate their points to good causes, including the American Red Cross and Unicef, among other renowned institutions.

The first step is knowing the customers’ preferences and aspirations in order to offer rewards that will make a difference for them.

Banks and financial services companies with successful loyalty programs use customer data to tailor rewards to individual preferences.

While sophisticated technology is essential for this, it is worth it.

It is clear that creating emotional ties allows brands to transcend the usual boundaries of transactional interactions.

Brands that understand the power of emotion in loyalty strategies are poised to develop deeper, more meaningful relationships with their customers, leading to lasting loyalty.

And this is critical since 59% of American consumers say that once they’re loyal to a brand, they’re loyal to it for life.

How Can BONDAi Help?

BONDAi is a relationship-based loyalty platform specifically designed for Wealth Management and Enterprise organizations to drive leads, loyalty, and advocacy.

Used by some of the largest Financial Services companies in the world, BONDAi helps companies build real relationships with their clients with personalization, exclusive experiences that deliver the wow, and value-added rewards that go beyond the transaction.